We looked at over 230 properties in Northridge either currently active or sold in 2017. Here's what the data tells us about the market and what folks should know if they're looking to jump in or if they're already in the mix.

Here are the key takeaways:

- There are currently 105 active listings in Northridge, 89 are single family detached homes and the rest are condos / town houses. This is the size of the active pool buyers are considering if they want to move to Northridge. For sellers, this is your larger competitive pool.

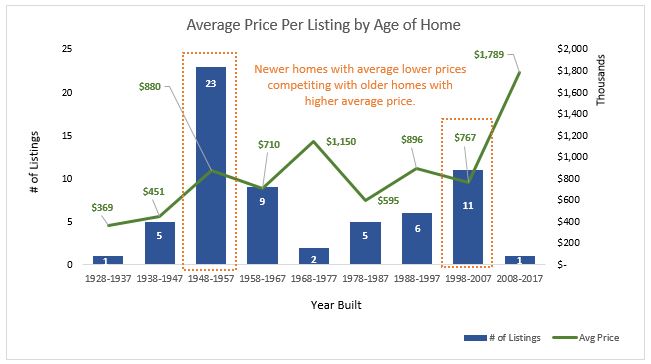

- The average price is $839K, while median is $755K. When average is greater than the median, this means there are a handful of really expensive homes pulling the average up (very common in LA).

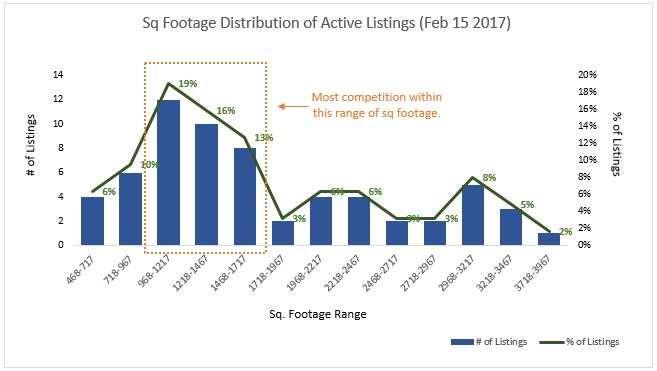

- In terms of size, we have a pretty normal distribution--both median and average are around 1640 sq ft, on the larger side relative to the rest of LA.

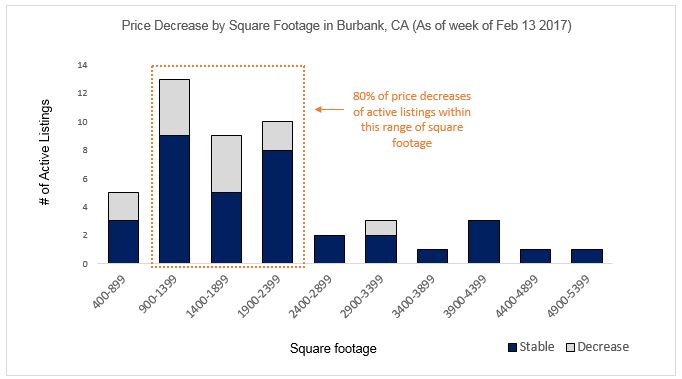

- Out of the 105 listings, 32 have changed their price. Most of which (about 85%) have been price decreases. The average price decrease is $33K while median is $22K.

- 134 properties have closed in 2017 thus far. Median selling price is around $600K, while average is $635K. Average days on market is about 53, median is 38. This is the sweet spot for sellers as we move into the selling season.

Okay so what does all this mean?

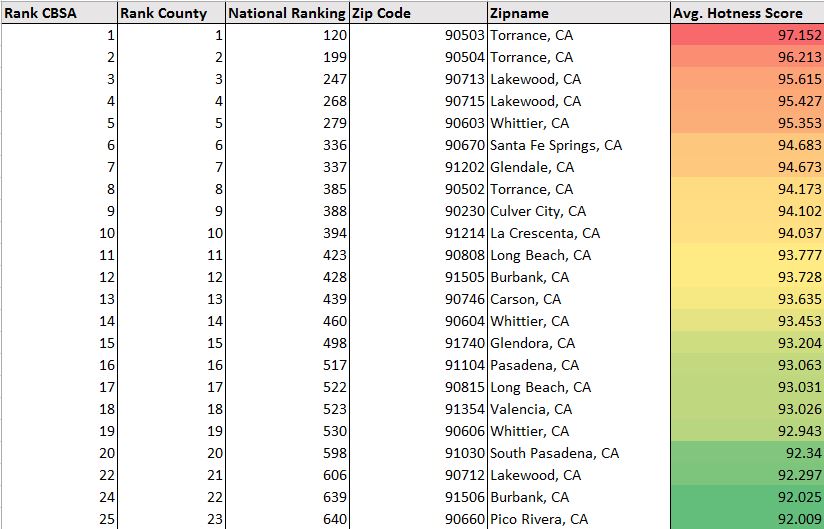

First, in terms of active listings, Northridge is a very competitive market!

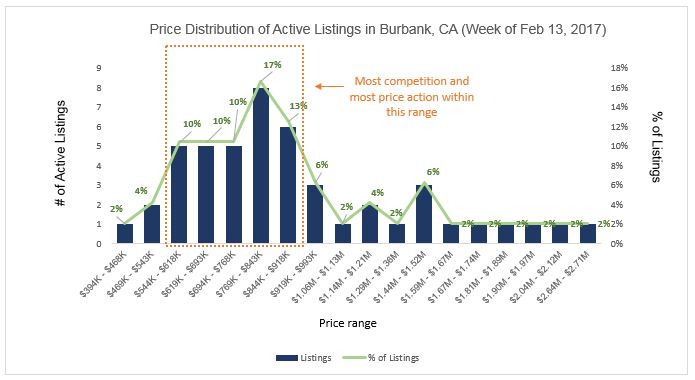

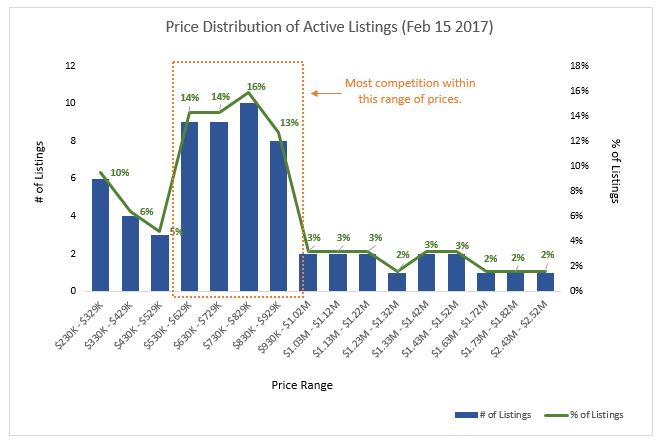

A big chunk of homes are around the same size, but have significant variance in price. This means plenty of room to negotiate for buyers, and pressure on sellers to defend value. I love this sort of competition. We're seeing this play out in the price action.

Second, we're seeing price action for almost 30% of active listings, with most lowering their price. Agents and their clients seem to be jumping in with high expectations and unfortunately weak marketing skills, because prices are dropping.

Finally, based on the data of closed deals in 2017, we're seeing houses at the lower price points close. This makes total sense right now. With a pretty normal distribution of size, buyers are grabbing deals at the lower end because these homes have the most upside.

This is the type of action I like to see and it's the type of competition I like to get into. If you're looking to jump in the market, or perhaps you're already there, reach out and we can talk strategy.