Over 100 residential properties have closed in Arcadia in 2017 and about 200 are currently active and listed for sale. Here's what the data tells us about this coveted LA community.

Key Takeaways:

- Of the 100+ homes sold in Arcadia in 2017, the average selling price has been $1.4M, while the median is $1.1M. Although average is greater than median, we're seeing a much tighter band in Arcadia relative to the rest of LA, so homes are more normally distributed in terms of price.

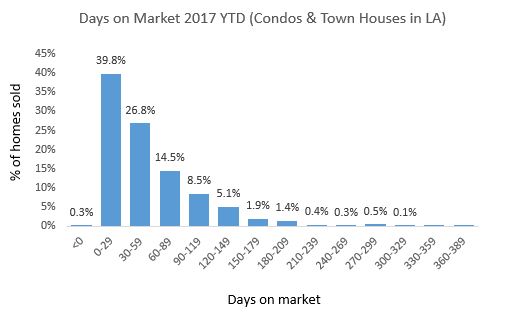

- Average days on market for homes sold is 64, while median is 50. Generally speaking, homes are sitting on the market for about 2 months before selling. This is more or less true across all price points in Arcadia and is higher than the LA average by about 10 days.

- There are currently 20 homes listed in Arcadia below the $1M price tag. And with most selling prices in the $1.1M - $1.4M range, this means lots of potential upside for buyers and an opportunity to sell for homeowners looking to list below $1M.

So what does all this mean?

Well, first Arcadia is certainly one of the higher priced real estate markets in LA, with most homes going for over $1M. With higher price tags comes more days on market, so patience is key for locking in value for both buyers and sellers.

Well qualified buyers have opportunities to buy below $1M and gain plenty of equity in the near term. Homeowners looking to sell below $1M also have a unique positioning opportunity for home buyers looking to ramp up on equity.

Arcadia is definitely a challenging market given current price points and just stagnation in LA on the higher end of the market. However, there are opportunities in the low end price points that could be attractive for speculative buyers and homeowners who seek them.

We love talking strategy here at Contempo, especially when it comes to positioning difficult homes in what appears to be cold markets. Arcadia is just one example.

If you're looking to sell or looking to buy properties with the most upside, reach out and we can talk strategy.

Sellers can also try our free market analysis to get a view into who you're competing with for the best buyers.