Burbank is one of the most competitive markets in LA. Recent price action says a lot and buyers and sellers should take note. We analyzed price movements to show you where there's high competitive pressure.

Here are the key takeaways:

- There are 48 active listings in Burbank for single family residences. This is the size of the active pool buyers are considering if they want to move to Burbank. For sellers, this is your larger competitive pool.

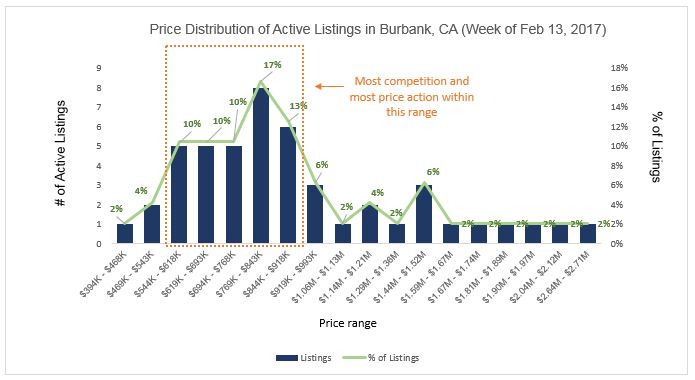

- The average price is $973K, while median is $820K. When average is greater than the median, this means there are a handful of really expensive homes pulling the average up (common in LA).

- Two-thirds of active listings are between $540K - $900K. This is where we're seeing most of the pricing action. This is the meaty part of the market.

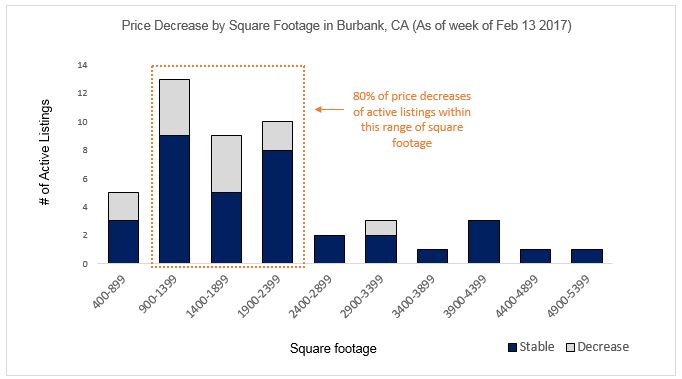

- Since December 2016, we've seen 13 price decreases among active listings. That means 27% of all active listings in Burbank have lowered their prices.

- The average price decrease is $21K, median is $15K. This is especially interesting considering many believe this is a sellers market (low supply high demand).

- What we're actually seeing is an overestimation of value and weak positioning of homes for almost a third of active listings in Burbank.

It will be interesting to see what kind of price action we'll see in the future, especially as more listings flood the market this spring. This is something buyers and sellers should pay attention to closely, especially if they wanna jump in the market.

It's only gonna get more competitive, so you need to be prepared. We can help. Try our free market analysis service. We'll get back to you with a tailored assessment of your market.