Having the right expectations can mean the difference between closing the best deal and settling for a lower price. This is especially true when it comes to optimal days on market for residential listings.

In this post, we analyzed about 2700 deals closed in the LA area for 2017 to give sellers a view into what they can expect when they enter the playing field.

Key takeaways:

- About 2700 residential property deals (from single family homes to condos & town houses) have closed in 2017 year-to-date (**see areas below).

- On average, detached single family homes are on the market for 59 days before selling. On average, condos & town homes are on the market for 54 days before selling. Median days on market are notably much lower. The median days on market for detached single family homes is 42 and for condos & town homes 40.

- When average is higher than median, this means a small group of homes are staying on the market much longer and pulling the averages up. In reality, the most realistic expectation for most sellers is around 40-42 days, or just over a month.

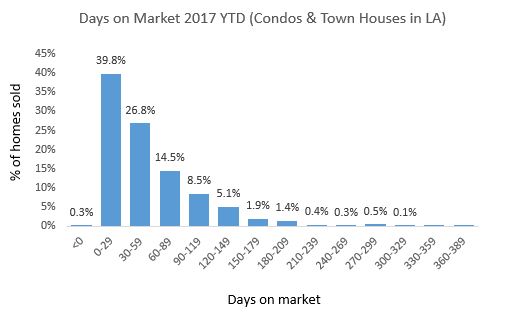

- For condos and town houses, 40% of homes sell within the first month of being listed. The same is true for detached single family homes. So another reality is that most will be waiting more than a month.

- When we look at days on market by home size, numbers change significantly. Homes under 1800 square feet can expect to sell within the first 2 months, but above 1800 square feet we see numbers go up significantly above 2 months.

- Size plays a big role in how long you can expect for your home to sit in the market in LA.

**Areas we analyzed: Los Angeles, Burbank, Glendale, Pasadena, Sherman Oaks, Northridge, Tarzana, Beverly Hills, Granada Hills, Van Nuys.**

So what does this all mean? First, sellers are facing days on market upwards of a month on average for both detached single family homes and condos. This is mostly true for homes below 1800 square feet. So if you fall into this category, it is not unfair to expect this type of performance from your realtor.

Second, larger homes are sitting on the market much longer. Homes above 1800 square feet can expect upwards of 2 months sitting on the market. Thus, folks with larger homes and their realtors have more work to do in terms of finding and competing for the right buyers. Based on this early data, larger homes and the luxury market are facing the most headwinds.

All in all, 2017 is shaping up to be what I call a year for strategic patience. But if you can't afford to wait and don't want to put your future on hold (nor should you!), there are ways to beat these numbers and we have proven strategies to do so.

Interested in learning more? Feel free to reach out and get a better idea of what we can do for you. You can also try our free market analysis, and we'll provide something tailored just for you to get you started on your selling journey.