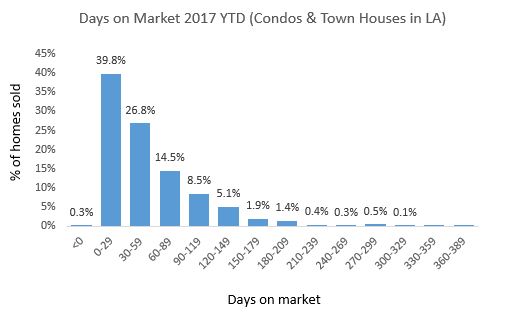

So what does this all mean? First, sellers are facing days on market upwards of a month on average for both detached single family homes and condos. This is mostly true for homes below 1800 square feet. So if you fall into this category, it is not unfair to expect this type of performance from your realtor.

Second, larger homes are sitting on the market much longer. Homes above 1800 square feet can expect upwards of 2 months sitting on the market. Thus, folks with larger homes and their realtors have more work to do in terms of finding and competing for the right buyers. Based on this early data, larger homes and the luxury market are facing the most headwinds.

All in all, 2017 is shaping up to be what I call a year for strategic patience. But if you can't afford to wait and don't want to put your future on hold (nor should you!), there are ways to beat these numbers and we have proven strategies to do so.

Interested in learning more? Feel free to reach out and get a better idea of what we can do for you. You can also try our free market analysis, and we'll provide something tailored just for you to get you started on your selling journey.